- Deal seems expensive, but we see great potential value in the future

- Deal will be concluded by the very beginning of 2011 with 100% debt financing

- Revised 2011 earnings down 6.5%, but 2012 up 7.8%

- Upgrade to Outperform with a target price of Bt87.00 (from Bt73.00, up 19.2%)

The deal was expensive…

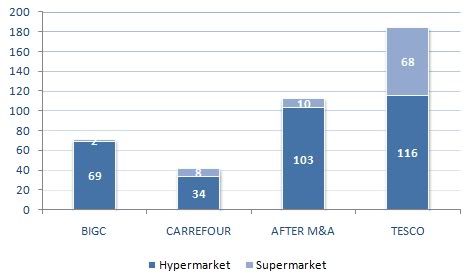

BIGC was the winner in the bid for Carrefour at a cost of €868mn (Bt35.5bn). Carrefour operates 42 stores (34 hypermarkets and 8 supermarkets) with 75.0% in leasehold. The average remaining leasehold life is more than 20 years with renewable option. The company revealed that the acquisition cost was at EV/EBITDA 2010 multiple of 8.6x which is a slight premium to BIGC at 8.4x. The average cost per store is at Bt845mn which is higher than its normal average cost of Bt500mn.

|

| Thailand's Hypermarket Positioning After Big C Acquired Carrefour |

…but the long-term potential is great

Even though the average cost per store is expensive, especially for leasehold, we see great value ahead in terms of expansion and synergy. We see some substantial benefits; i) jump in expansion; ii) greater negotiating power or higher gross margin; iii) better economies of scale or lower SG&A to sales, and iv) greater leasable area.

Recent expansion opportunities in Greater Bangkok area are impossible due to regulations.

After the acquisition, BIGC’s stores in Greater Bangkok will increase from 27 stores to 57 stores. The average price of land in Greater Bangkok has increased by 10.0-20.0% per annum, so we believe the acquisition cost is reasonable if we think in terms of future value and expansion opportunity. If we regard the Bt345mn (Bt845mn minus Bt500mn) cost per store as a sunk cost, and with the 20-year lease and renewal option, and assume only 40 years operation on the asset, the premium cost per year will be low at Bt8.6mn. A store can generate a net profit of Bt46mn.

Therefore, BIGC still can make money out of this acquisition. Apart from the great expansion benefit, we also see the benefit from the improved economies of scale. After the acquisition, the number of BIGC’s hypermarkets will surge to 103 from 69 (+49.3%). This increase implies greater negotiating power with suppliers or better gross margin and improved economies of scale or lower SG&A to sales. Additionally, the rental area is estimated to jump 34.5%. The rental business has become the main driver for BIGC’s earnings with approximately 40.0% of its earnings are derived from rental incomes.

100% debt financing deal

Although, the value of the deal is huge, the company targets to finance 100% of it with debt. The company will borrow first from overseas commercial banks and switch to local commercial banks later. With its strong cash flow, BIGC expects to repay all the debts within five years. The company expects to conclude the deal by the beginning of 2011. We estimate that the gearing ratio in 2011 will soar to 1.6x from zero interest-bearing debts in 2010, but expect it to fall below 1.0x in 2013.

Revised 2011 earnings down 6.5% but 2012 up 7.8%

We revised 2011 earnings down 6.5% due to the surge in interest expenses. In 2012, we adjusted earnings up by 7.8% thanks to higher rental income, rebate income, better gross margin, smaller SG&A to sales and lower interest expenses.

Valuation and Recommendation

We upgrade the counter to Outperform from Neural with a target price of Bt87.00 (from Bt73.00, up 19.2%), based on discounted cash flow on a five-year horizon with WACC of 10.5% and terminal growth rate of 3.0%.

to see the BIGC stock research by Aungkana Tungwikromkrai, CFA KGI Securities http://www.settrade.com/brokerpage/AnalystConsensus/Research/kgi_bigc.pdf

No comments:

Post a Comment